With Chapter 13 bankruptcy, you may reorganize your debts to help make them a lot more affordable. You can expect to ordinarily get on a three- or five-calendar year repayment strategy, throughout which you are going to pay again some or all of Anything you owe. Once the repayment program is finished, any remaining personal debt are going to be canceled on discharge.

Filers with considerable discretionary income are necessary by the court to pay component or all of their credit card personal debt by using a Chapter 13 repayment prepare. A individual bankruptcy may also stay on your credit file for seven to ten years. Subsequently, it’s significant to consider all of your selections to start with.

Whichever bank loan you end up picking, generally pay the charges by the due date each month. If there’s no early repayment penalty, make even larger payments over the mortgage When you've got The cash readily available.

What transpires to "nonexempt" house that won't protected will rely on the bankruptcy chapter you file. So you'll be wanting to assessment your condition's exemption legislation and look at the personal bankruptcy chapter.

You don’t need to spend it all of sudden, which is excellent news. Based on the duration within your repayment system, you’ll pay back it over three to five years.

When you follow these techniques, and just take treatment in order to avoid repeating earlier missteps, you will discover that the credit scores will start increasing in a number of years after your bankruptcy filing.

Editorial Policy: The knowledge contained in Inquire Experian is for instructional uses only and isn't check my source legal suggestions. You should consult your own attorney or request precise tips from a authorized Experienced with regards to any legal difficulties.

Despite the fact that personal bankruptcy can provide definitive aid from credit card debt, there might be other means to obtain the guidance you may need without the need of impacting your credit as much. Here are a few choices to consider.

In the end, time will be the biggest remedy on your personal bankruptcy-relevant credit score ailments. If you are patient and commit to superior credit habits, your credit rating will slowly visit the website but certainly look these up rise.

All information and facts, which include rates and fees, are precise as of your day of publication and are up to date as provided by our associates. Some of the offers on this page will not be obtainable by way of our Web page.

Consider credit card features. After you have logged a yr or two of favourable payments via a credit-builder loan, a secured credit card or equally, commence watching your inbox and i was reading this mailbox for credit card provides. The pickings may very well be slim: borrowing restrictions small, interest rates somewhat superior and fees lower than suitable.

Though there isn't any limit to the quantity of bankruptcies you can file, you're restricted in how frequently it is possible to file for personal bankruptcy. You'll have to wait two to 8 years, according to the personal bankruptcy chapter click here for more you submitted Earlier and what you want to file now.

Failure to produce minimum required bank loan payments on-time could result in your mortgage payment(s) remaining documented as delinquent to credit bureaus which can negatively effect your credit profile.

Solution several easy questions about your financial loan ask for. Equifax will deliver your zip code and the kind of personal loan you have an interest in to LendingTree.

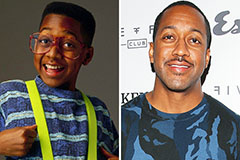

Jaleel White Then & Now!

Jaleel White Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Tiffany Trump Then & Now!

Tiffany Trump Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!